Table of Contents

Unpacking Leadership, Legacy, and the Power Behind the Brand

If you’ve ever had a conversation about auto or home insurance, the name Allstate probably came up. It’s one of those brands that feels both familiar and foundational—like a sturdy seatbelt or a reliable roof. But have you ever wondered: who actually owns Allstate Insurance?

Is it a single mogul? A family dynasty? Or maybe a vast network of shareholders quietly pulling the strings behind the scenes?

In this post, we’re peeling back the corporate curtain to explore not just who owns Allstate Insurance, but how its ownership has evolved, what it means for policyholders, and why this matters more than you might think.

📌 A Quick Overview of Allstate Insurance

Founded in 1931 as part of Sears, Roebuck and Co., Allstate was originally a mail-order auto insurance provider. Yes—insurance by mail. The name came from a tire brand Sears was selling, and the company started out as a bold experiment in making insurance more accessible to middle-class Americans.

Fast forward nearly a century, and Allstate is now one of the largest publicly traded insurance companies in the U.S., offering a range of products including:

- Auto insurance

- Homeowners insurance

- Life insurance

- Renters insurance

- Business and identity protection

But ownership of a company like Allstate isn’t as simple as pointing to one person. Let’s break it down.

👥 Is Allstate Privately Owned?

Short answer: No. Allstate is a publicly traded company.

Unlike privately held companies that are owned by a small group of individuals or a family, Allstate’s ownership is distributed among thousands of shareholders. Anyone with a brokerage account can technically own a piece of Allstate by purchasing its stock, listed as ALL on the New York Stock Exchange.

Key Shareholders (as of recent filings):

| Shareholder | Type | Ownership Stake |

|---|---|---|

| The Vanguard Group | Institutional | ~8% |

| BlackRock, Inc. | Institutional | ~7% |

| State Street Corp | Institutional | ~5% |

| Retail Investors | Individual | ~20% combined |

| Allstate Executives | Insider Ownership | <1% individually |

These massive investment firms don’t “run” Allstate day-to-day, but they do have significant influence through voting power at shareholder meetings.

🧠 Who Runs Allstate Insurance?

Ownership and leadership are different beasts. So while institutional investors own chunks of Allstate, the executive leadership team handles the operations, strategy, and innovation.

🚀 Current CEO: Tom Wilson

Tom Wilson has been the CEO of Allstate Corporation since 2007, and Chairman since 2008. Under his leadership, Allstate has aggressively shifted toward digital innovation and expanded its portfolio through acquisitions—like the 2021 purchase of National General Insurance.

“At Allstate, we don’t just sell insurance—we empower people to live a life well protected.” – Tom Wilson

Wilson’s compensation is aligned with shareholder interest, often including bonuses based on the company’s financial performance and stock appreciation.

🏛️ The Board of Directors

Allstate’s Board of Directors plays a crucial governance role. While shareholders technically “own” the company, the board ensures it is run responsibly, ethically, and in line with long-term shareholder value.

Notable directors include executives from finance, tech, and regulatory backgrounds. This diversity helps Allstate navigate the complex landscape of modern insurance, including issues like climate risk, cybersecurity, and evolving customer expectations.

📚 A Look Back: From Sears to Independence

Allstate was born in 1931 inside the Sears Tower (Chicago). Sears owned Allstate until 1993, when Allstate was spun off via an IPO and became an independent public company. This was a turning point that enabled Allstate to scale beyond the Sears brand and grow into a national powerhouse.

This spin-off story is important because it reflects a broader trend in American capitalism: corporate diversification and specialization. Sears couldn’t keep up with retail changes, but Allstate’s ability to adapt made it stronger than ever.

💡 Why Ownership Matters in Insurance

You might be thinking: So what if Allstate is owned by institutions? How does that affect me as a customer?

Great question. Here’s how ownership ties directly into your insurance experience:

1. Profit-Driven vs. Policyholder-Driven

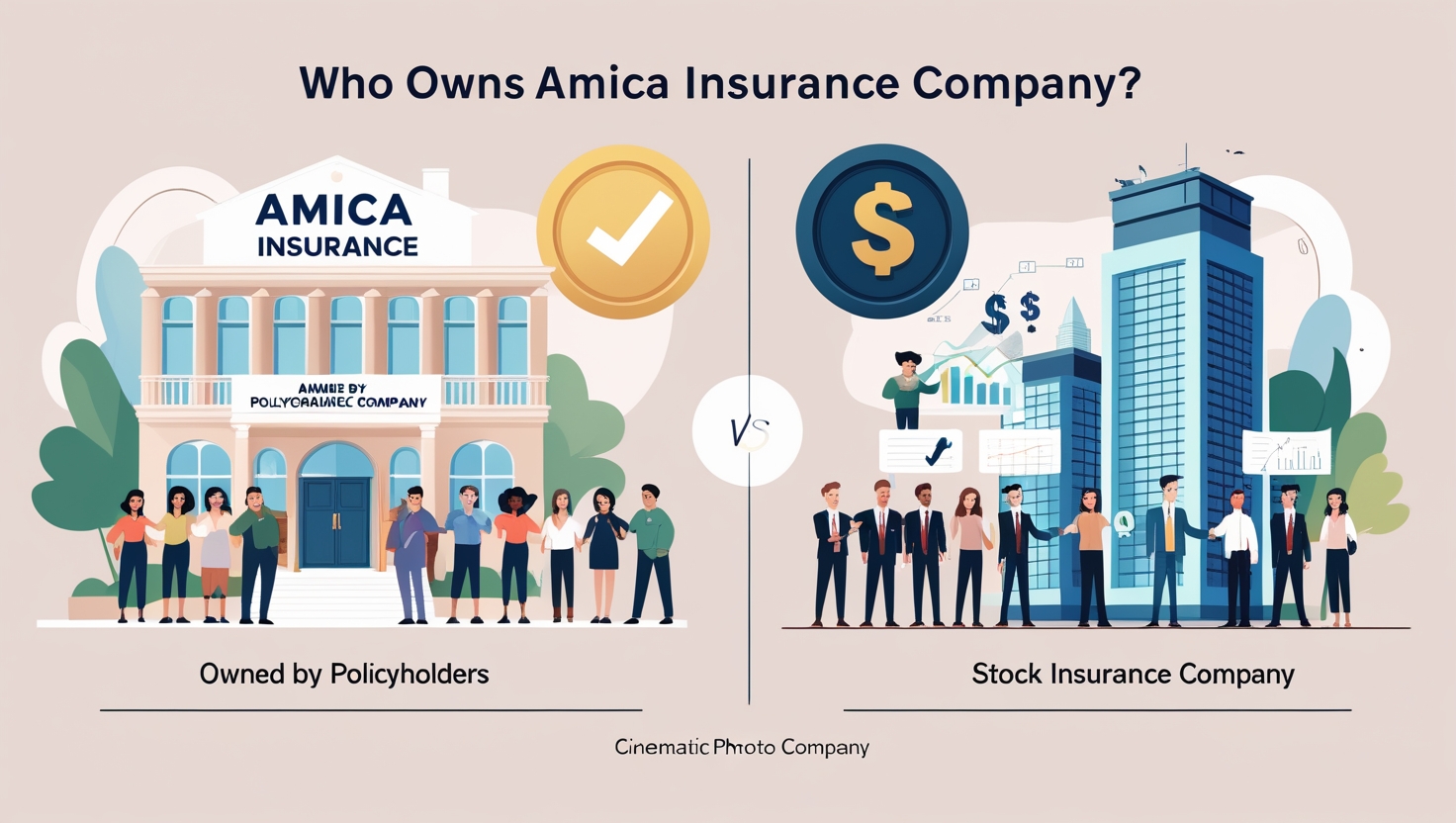

Unlike mutual insurance companies (like Amica, where policyholders are technically the owners), public companies like Allstate are accountable to shareholders. That means decisions are often made with profitability in mind.

This can be a double-edged sword:

- ✅ Pro: Stronger financial discipline, innovation, and market competitiveness.

- ❌ Con: Premiums or claim decisions may lean toward protecting bottom lines.

2. Stability and Investment Capacity

Being publicly traded gives Allstate access to capital markets, allowing it to invest in tech, offer new products, and stay resilient during catastrophes. The flipside? It must deliver quarterly earnings that satisfy Wall Street.

🔍 Comparing Ownership Models in the Insurance World

Let’s look at how Allstate’s ownership structure stacks up against other major insurance players:

| Company | Ownership Type | Notable Facts |

|---|---|---|

| Allstate | Publicly Traded | Institutional investors like Vanguard, BlackRock hold stakes. |

| State Farm | Mutual (Policyholders) | Owned by policyholders; excess profits may result in dividends. |

| GEICO | Wholly Owned Subsidiary | Owned by Berkshire Hathaway (Warren Buffett’s company). |

| Progressive | Publicly Traded | Similar structure to Allstate; shareholder-focused. |

Each model has pros and cons. Public companies tend to be more innovative but may be less personal. Mutuals offer stronger alignment with customers but may move slower.

🎯 Personal Insight: As a Policyholder, Should You Care?

Honestly? Yes.

As someone who’s been an Allstate customer for over five years, I’ve had a front-row seat to the evolution. Their mobile app, self-service tools, and claims responsiveness have drastically improved under Wilson’s leadership—and it’s no coincidence.

Still, I’ve also seen premiums rise more than expected some years, and claim processes sometimes require extra persistence. These are reflections of a profit-centric model—a byproduct of being a publicly traded insurance giant.

If you value tech-forward convenience, Allstate shines. If personal connection and dividends matter more, mutual companies may feel more “human.”

🌐 Internal & External Resources for Further Reading

Want to dive deeper? Check out these helpful reads:

- Allstate Corporation – Investor Relations

- Yahoo Finance: Allstate Corp. (ALL) Stock

- Tom Wilson’s Executive Profile on Allstate

And if you’re shopping around, compare with our other breakdowns on:

🧭 Final Thoughts: So, Who Really Owns Allstate Insurance?

In the end, Allstate is owned by the people—just not in the way you might expect. It’s a corporation guided by shareholders, shaped by institutional powerhouses, and operated by a team of seasoned executives.

The question isn’t just who owns Allstate Insurance, but how that ownership model impacts your experience as a policyholder. Whether it leads to cutting-edge digital service or higher rates is a delicate balance.

One thing is certain: understanding the ownership behind your insurance provider helps you become a smarter, more empowered consumer.

✅ Ready to Take the Next Step?

If you’re currently with Allstate or considering switching, now’s a great time to review your policy. Ask yourself:

- Is this coverage still aligned with my needs?

- Am I getting the best value for my premiums?

- Does the ownership model reflect my expectations for service?

👉 Let us know your thoughts in the comments, or check out our insurance comparison guide to explore options that better fit your values.

Stay informed. Stay protected. You’re in good hands. ✋