Table of Contents

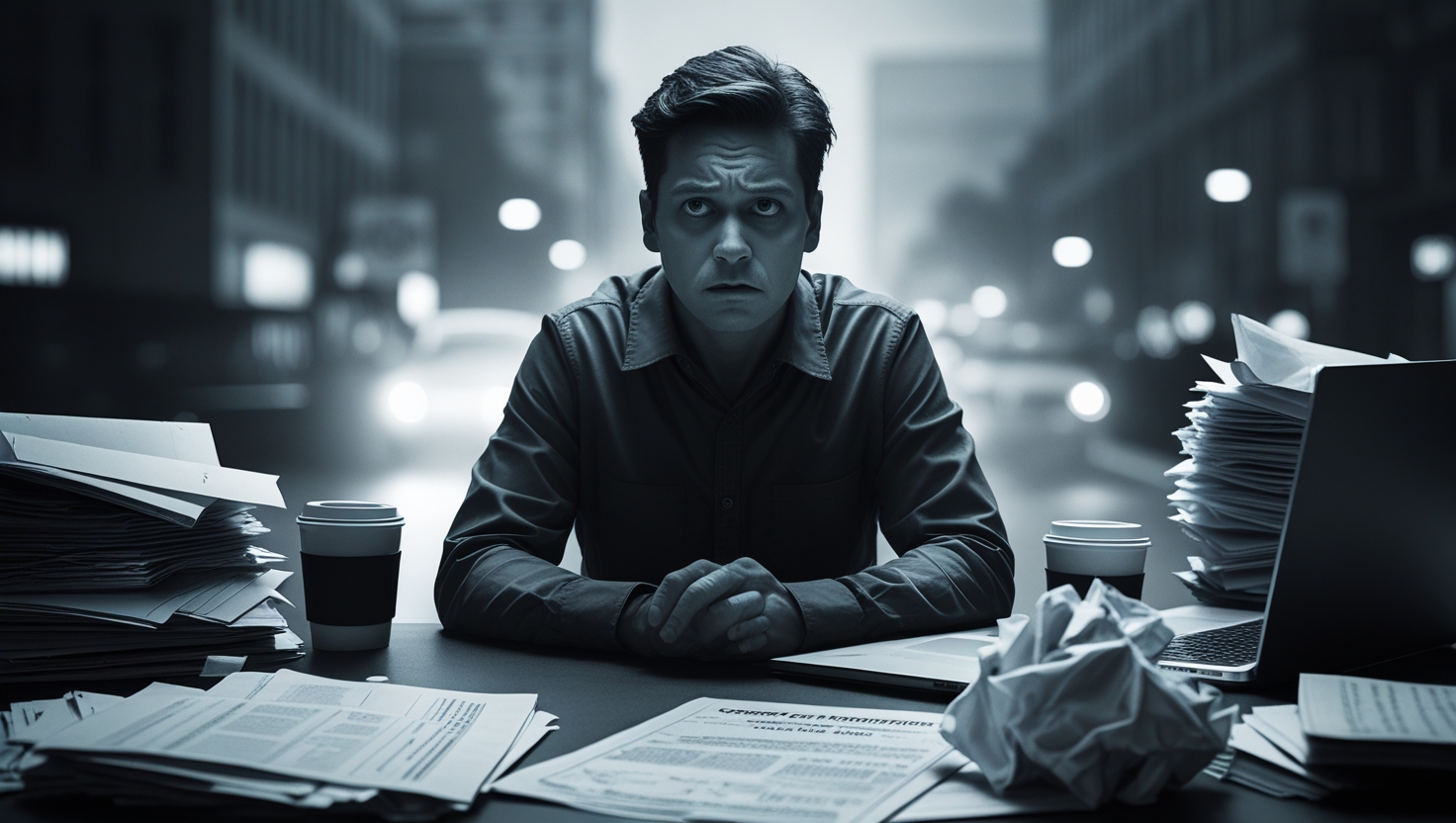

When the Unthinkable Happens—And Insurance Isn’t There

You’re driving home from work when—bam!—someone runs a red light and slams into your car. The damage is serious, and you’re hurting. But things go from bad to worse when you find out the other driver doesn’t have insurance.

Now what?

This is a nightmare scenario, and unfortunately, it’s more common than you might think. According to the Insurance Research Council, about 1 in 8 drivers in the U.S. is uninsured. So, the question is: Can you sue someone who doesn’t have insurance? The short answer is yes—but whether it’s worth it is a different story.

Let’s break down your options, what you need to know, and how to protect yourself if you’re ever in this situation.

Yes, You Can Sue Someone Without Insurance—But Here’s the Catch

From a legal standpoint, you can absolutely sue someone who doesn’t have insurance if they caused an accident or damage. The legal system doesn’t prevent you from seeking compensation simply because the at-fault party failed to carry insurance.

However, winning a lawsuit and collecting money are two very different things.

Here’s what to consider:

| Factor | Why It Matters |

|---|---|

| Liability | Can you prove they were at fault? |

| Collectability | Do they have income or assets to pay the judgment? |

| State Laws | Some states limit what assets can be seized. |

| Legal Costs | Filing and pursuing a lawsuit isn’t free. |

Even if the court awards you damages, you might end up with a piece of paper instead of a paycheck if the defendant has no assets or income. This is known as being “judgment proof.”

Understanding the Legal Process: How a Lawsuit Works Without Insurance

If you do decide to sue someone without insurance, here’s what the general process looks like:

1. File a Claim in Civil Court

You’ll start by filing a claim for damages, which can include:

- Medical bills

- Vehicle repair or replacement

- Lost wages

- Pain and suffering

If the claim is under a certain amount (varies by state), you might be able to file in small claims court, which is quicker and cheaper.

2. Prove Liability

As the plaintiff, you’ll need to prove that the uninsured individual was at fault. Police reports, witness testimony, and video footage can all support your case.

3. Receive a Judgment

If the court rules in your favor, you’ll receive a judgment stating how much money the defendant owes you.

4. Enforce the Judgment

Here’s where things get tricky. If the person doesn’t voluntarily pay, you may need to:

- Garnish wages (if they have a job)

- Put a lien on property (if they own any)

- Seize bank accounts (if allowed in your state)

But if they have no job, property, or assets, your judgment may be nearly impossible to collect.

Alternatives to Suing: Other Ways to Get Compensated

Litigation isn’t your only option. Depending on your own insurance coverage and state laws, you may have other ways to recover your losses.

✅ Uninsured Motorist Coverage (UM/UIM)

If you have this optional coverage on your policy, it can pay for:

- Medical expenses

- Lost wages

- Pain and suffering

This coverage kicks in specifically when the at-fault driver has no insurance (or not enough of it). According to the National Association of Insurance Commissioners, UM/UIM is one of the most important add-ons you can have.

✅ Collision Coverage

This pays for repairs to your vehicle regardless of who was at fault—great for hit-and-runs or uninsured drivers.

✅ Health Insurance

Your health insurance can cover medical costs, though deductibles and out-of-pocket expenses may still apply.

Real-World Insight: When Suing an Uninsured Driver Makes Sense

✅ They Have Assets

If the at-fault driver owns property, has a well-paying job, or other significant assets, suing may be worthwhile.

✅ You’re Seriously Injured

In cases involving long-term injury or disability, the potential payout might justify the legal battle—even if collection takes time.

✅ They May Be Eligible for Future Garnishment

Even if the person is broke now, a judgment lasts for several years (often 7–20 years, depending on your state) and can be renewed.

When It Might Not Be Worth It

On the flip side, suing someone without insurance often isn’t the best course of action if:

- They’re unemployed and without assets

- You don’t have uninsured motorist coverage

- The damages are minor

- You’re not willing to invest time and money into a legal fight

In these cases, it may be more cost-effective—and less stressful—to file a claim with your own insurer or chalk it up to a tough lesson.

How Different States Handle It: A Legal Comparison

State laws can drastically affect your outcome. Here’s how a few notable states handle these situations:

| State | Notable Rule |

|---|---|

| California | You can sue, but uninsured drivers cannot claim non-economic damages. |

| Texas | Allows wage garnishment and asset seizure, but protections apply for basic needs. |

| Florida | No-fault state—your own insurance pays first unless there’s serious injury. |

| New York | Strong UM/UIM laws help protect victims of uninsured drivers. |

🗺️ Check your state’s uninsured motorist laws here.

Pro Tips: What to Do Immediately After an Accident with an Uninsured Driver

- Call the Police – Get an official report.

- Gather Evidence – Photos, witness statements, and dashcam footage help build your case.

- Seek Medical Attention – Document your injuries early.

- Notify Your Insurance Company – Even if you weren’t at fault.

- Consult an Attorney – Especially if injuries are serious or the case is complex.

What If the Driver Fled the Scene?

Hit-and-runs are often committed by uninsured drivers. In these cases:

- File a police report immediately.

- Use your uninsured motorist or collision coverage if available.

- Check for surveillance footage or eyewitnesses.

Can You Report Someone for Not Having Insurance?

Absolutely. In most states, it’s illegal to drive without insurance. If you’re involved in an accident, make sure to:

- Inform the police

- Share the information with your insurance company

- Consider reporting the incident to your local DMV

Some states will revoke licenses or fine uninsured drivers heavily.

Final Thoughts: Your Legal Rights vs. Your Practical Options

You have every right to sue someone who doesn’t have insurance. But just because you can, doesn’t always mean you should. Think carefully about:

- The person’s ability to pay

- Your own financial and emotional investment

- Alternative options like insurance coverage or legal mediation

In some cases, a quick settlement from your insurer might be a better path forward than a lengthy legal battle that leads to nowhere.

Stay Protected: The Power of Insurance

If there’s one takeaway, it’s this: Make sure your own insurance is rock solid. UM/UIM and collision coverage can be lifesavers when the other driver drops the ball.

Call to Action

Have you ever dealt with an uninsured driver? Share your experience in the comments below—we’d love to hear how you handled it. And if you found this guide helpful, check out our other posts on:

- Does the At-Fault Driver’s Insurance Pay for a Rental Car?

- Can You Get Commercial Insurance with a DUI?

- Do Dealerships Require Full Coverage Insurance?

Need help reviewing your current auto policy? Contact one of our insurance partners today and make sure you’re fully protected.

Awesome https://is.gd/tpjNyL